The latest monthly report of General Revenue (GR) collections announced by Treasurer Ken Miller provided the strongest indications yet that state revenues are on a firm path to recovery. For the 11th time in the past 12 months, monthly revenue collections surpassed those of the same month a year ago; as the first chart shows, January’s growth of 19.5 percent was easily the strongest we have yet seen:

Another measure of recovery involves comparing monthly revenue collections this year to the month’s average over the past five years. January’s collections hit just under 95 percent of the monthly January average of the past five years, which is the best performance since revenues began to plunge two years ago:

Another measure of recovery involves comparing monthly revenue collections this year to the month’s average over the past five years. January’s collections hit just under 95 percent of the monthly January average of the past five years, which is the best performance since revenues began to plunge two years ago:

Two caveats remain in order. The first is that while revenue from most of Oklahoma’s major taxes has grown substantially over the first seven months of FY ’11 – ranging from a 10.2 percent increase in the sales tax to a 53 percent increase in the motor vehicle tax – personal income tax collections remain sluggish:

Two caveats remain in order. The first is that while revenue from most of Oklahoma’s major taxes has grown substantially over the first seven months of FY ’11 – ranging from a 10.2 percent increase in the sales tax to a 53 percent increase in the motor vehicle tax – personal income tax collections remain sluggish:

So far this year, personal income tax collections have come in below the estimate developed last February. Treasurer Miller explains this weakness as typical of the early stages of an economic recovery:

So far this year, personal income tax collections have come in below the estimate developed last February. Treasurer Miller explains this weakness as typical of the early stages of an economic recovery:

“Personal income tax collections are higher than the previous year, but lag slightly behind estimates,” he said. “The lag in employment gains, and the correlating lag in personal income growth, is typical of the early stages of recovery underscoring the need for continued improvement.”

It is true that Oklahoma’s unemployment rate has remained stubbornly high – at 6.8 percent in January, the unemployment rate is barely below its high of 7.0 percent during the worst of the recession. Yet the state has enjoyed three straight quarters of strong growth in personal income. And nationally, personal income tax collections have been growing as robustly as sales tax collections despite continued high levels of unemployment. This suggests that other factors, such as the continued proliferation of tax credits, deductions and exemptions, may be playing a part in hampering income tax collections in Oklahoma.

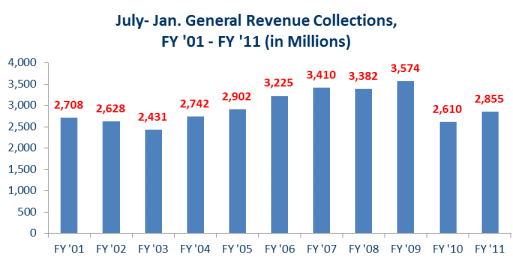

The second reason to temper our celebrations is that, despite the significant progress now being seen compared to FY ’10, revenues continue to come in far below pre-downturn levels. January’s GR collections of $490.2 million remains $48 million, or 9 percent below FY ’08. For the seven months year-to-date, FY ’11 collections are $719 million or 20.1 percent below FY ’09, and still below those of six years ago, FY ’05:

In climbing back up the cliff, the pace of our climb may have quickened, but we still have a long ways to go.

In climbing back up the cliff, the pace of our climb may have quickened, but we still have a long ways to go.

OKPOLICY.ORG

OKPOLICY.ORG

2 thoughts on “Quick Take: Revenues rebounding – – except for the income tax”