Oklahoma teachers and school districts all over the state have shut down schools since April 2nd to advocate for better funding of education and other core state services. This page compiles resources to help you understand the context for Oklahoma’s teacher walkout, how state finances ended up in this crisis, and what solutions lawmakers can use to resolve the crisis.

Latest Updates

- Fact Sheet: Is education fully funded? (4/12/2018)

- Will the teacher raise be delayed by a veto petition? (4/12/2018)

Infographics

Key facts on education funding and teacher pay

- State funding has been cut deeply in recent years. Over the past decade (FY 2009 to FY 2018), the budget appropriated by lawmakers has shrunk 16 percent, adjusted for inflation. Over half of all state agencies have seen their state funding cut by over 20 percent since 2009, even before accounting for inflation.

- Per pupil state aid funding to public schools has been cut 28.2 percent below 2008 levels, adjusted for inflation. This cut is the largest in the U.S. — no other state even tops 20 percent on this same measure.

- Cuts are hitting all aspects of public education. The impacts include growing class sizes, fewer course offerings (especially in the arts, technology, and foreign languages), districts going to four-day school weeks, scarce school supplies, and the elimination of support staff like librarians and school counselors.

- Oklahoma teachers’ average take home pay has shrunk 11 percent since FY 2006. Even in years when per capita personal income in Oklahoma was showing strong growth, teacher salaries did not improve. Compared to West Virginia, which recently went through a teacher strike, Oklahoma teachers receive similarly low pay and much worse overall education funding.

- Funding problems are not limited to teachers or education. Most state employees have gone more than a decade without a pay increase, and turnover of state workers has spiked as their salaries fall further behind the private sector.

How we got here

- Oklahoma’s tax system is no longer generating the revenue needed to pay for basic public services, even in good economic years. There are numerous indicators of a chronic and deepening budget gap, also known as a structural budget deficit.

- Repeated cuts to the state income tax made since the mid-2000s are one significant reason for the ongoing financial crisis. A decade of cuts to Oklahoma’s top income tax rate has reduced state revenues by more than $1 billion annually.

- Tax breaks for the oil and gas industry have also skyrocketed in recent years, and Oklahoma taxes this industry well below any of our peer oil and gas producing states. The current tax break for this industry is reducing revenues by more than $300 million annually.

- Other factors contributing to the budget crisis include rising health care costs, an aging population, economic changes the move more economic activity to things like services and online purchases that aren’t covered by existing sales taxes, and proliferating tax breaks. Some of these factors can be addressed on the state level while some require national reforms.

Solutions that Oklahoma lawmakers can pass to resolve the walkout

- The Oklahoma Legislature last week passed a set of bills to provide pay raises to teachers, school support staff, and public employees funded primarily by a tax increase on tobacco, motor fuels, and gross production. These bills mark a crucial step in tackling some of the state’s most urgent problems. But the new revenues fall short of fully funding new spending commitments. The state will also need additional revenue to balance this year’s budget and make greater investments in education and other needs in the future.

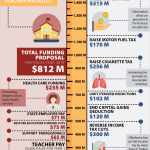

- Lawmakers have many good options for increasing revenues to resolve the teacher walkout. While OEA has made a funding request for teacher raises, improved general education and health care funding, and state employee raises that will cost $812 million in the first year, lawmakers have practical revenues options that could bring in as much as $1.4 billion annually.

- Increasing focus is on repealing the capital gains tax break as a solution to fully fund school needs. The capital gains deduction costs more than $100 million a year, and in 2014 nearly two-thirds of the benefit went to just 824 households with incomes of more than $1 million. It’s wasteful and expensive, and a repeal bill has already passed the Senate with a bipartisan majority.

- The teacher raise and revenue options that were approved by lawmakers could be threatened by a veto referendum being organized by anti-tax activists. If supporters of this referendum gather enough signatures to put it on the ballot, it could delay both the revenue increases and the teacher raise until after November elections.

Contact Your Legislators

Let your legislators know that you favor a comprehensive revenue solution to give teachers and state employees a raise and undo cuts to Oklahoma’s important core services.

OKPOLICY.ORG

OKPOLICY.ORG