As Oklahoma heads into a new budget year and closes the books on FY 2018, two things are especially clear: Oklahoma’s fiscal situation is much improved, but we still have a long ways to go to recover from a decade of deep budget cuts.

State revenue grew strongly last year

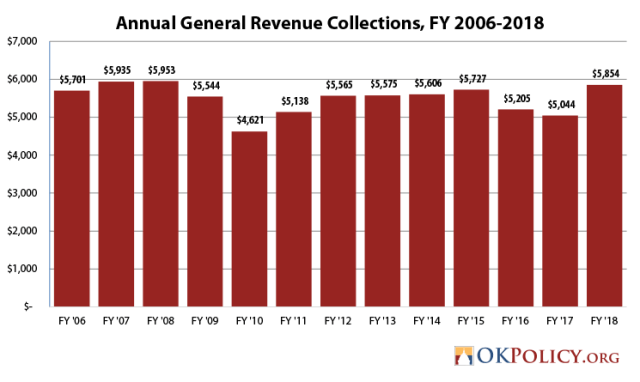

After several consecutive years of shortfalls and lagging collections, last year (FY 2018) was a good one for state tax collections. Total collections to the General Revenue (GR) fund, the principal funding source for most Oklahoma government operations, reached $5.85 billion in FY 2018, which was an increase of $810 million, or 16.1 percent from FY 2017. Last year’s GR collections were the largest since the start of the Great Recession in 2009, but they were still some $100 million below the pre-recession peak of 2008, as can be seen from the chart.

All major General Revenue sources saw growth in 2018 compared to 2017, with increased sales tax collections (+$285.9M) being the largest contributor to overall revenue growth, followed by the individual income tax (+$208.8M), gross production taxes (+$195.9M), and corporate income tax (+$62.2M). Legislative changes approved during the 2017 regular session and 2018 special session, which included adding a 1.25 percent sales tax on motor vehicle purchases and raising the tax rate on older horizontal wells to 7 percent, accounted for approximately $358.9 million of the total GR increase in FY 2018, according to the state budget office.

Gross Receipts to the Treasury — a broader measure of tax collections before any tax rebates, tax refunds, and remittances to cities and counties are paid out, and that includes earmarked revenues which do not go to the General Revenue Fund — increased by $1.2 billion, or 11.1 percent, in FY 2018. Total Gross Receipts in FY 2018 reached an all-time high of $12.2 billion, which is some $900 million, or 7.9 percent, above the prior annual peak of $11.3 billion back in FY 2008.

Last year’s General Revenue collections exceeded the official estimate by $381.6 million, or 7.0 percent. The full amount of this surplus will be deposited in the state Rainy Day Fund, in accordance with the constitutional provision stating that GR collections above 100 percent of the final certified estimate are deposited in the Fund. This year’s RDF deposit is the largest since the Fund was created in 1988 and brings the current balance to $453.8 million (see chart). The cap on the Fund, which is 15 percent of the current revenue estimate for the General Revenue Fund, is just above $750 million.

The current revenue outlook is positive

State appropriations for the current budget year, FY 2019, are $7.567 billion — an increase of $718.5 million, or 10.5 percent, compared to last year. Of the total budget growth, about $500 million is a result of revenue increases approved earlier this year primarily to pay for pay raises for teachers and other employees, with the rest attributable to economic growth. The major tax increases on cigarettes, motor fuels, and new oil and gas production took effect July 1st.

Initial tax collections for FY 2019 are mixed. Gross Receipts to the Treasury for July 2018 were up 10.8 percent compared to the prior year. Treasurer Ken Miller noted, “continued improvement in state employment, notably in the oil fields, and positive numbers in other economic indicators are continued signs of ongoing growth.” However, while General Revenue collections for July were up 9.2 percent from a year ago, they fell short of the official estimate by $9.6 million, or 2.1 percent.

We still have a long ways to go to make up for years of cuts

The revenue increases approved by the Legislature in 2017 and 2018, in conjunction with a growing economy, have stabilized the budget and allowed for some critical investments in the state’s most urgent needs. Yet there’s still a great distance to be climbed before we are out of the hole created by a decade of cuts and shortfalls.

As Senate Appropriations Chair Kim David stated during debate on the FY 2019 appropriations bill, “this budget in no way makes everyone as complete and whole as we were in 2009.” This year’s budget remains 9.4 percent ($788 million) below the budget of FY 2009 when adjusted for inflation, as can be seen from the chart above. As noted above, General Revenue collections, which are the primary funding source for most government operations, have not even fully returned to where they were over a decade ago, even without accounting for inflation and population growth. The effects of sustained cuts can still be seen across much of state government. For example:

- State support for K-12 school operations will remain $145 million less than in FY 2009 (not including the new money that must be dedicated to teacher and school staff pay raises), even as school enrollment has grown by over 50,000 students. The Legislature managed to increase state aid funding by only $17 million last session, just enough to offset mid-year cuts but not enough for most school districts to be able to replace teachers, counselors, librarians, and other positions lost in recent years. Most school districts are reporting that the teacher shortage is worse compared to last year and that they will continue to need emergency certification of teachers to fill vacancies.

- The Regents for Higher Education received an additional $7.5 million for concurrent enrollment programs, but no additional money to support operations of colleges and universities. Higher education funding will remain $263 million, or 25.3 percent, below its FY 2009 levels.

- State funding for the Department of Corrections is 2.8 percent above what it was in 2009, but the state’s inmate population has grown by close to 10 percent during this time, along with growing costs for medical care and other fixed expenses.

- The Adult Protective Services division within the Department of Human Services has lost 30 percent of its workers since 2014, while the number of investigations it is responsible for has jumped more than 50 percent.

- State employees will receive raises of $500 to $2,000 depending on their salary this year, but a study last year found that average salaries for state employees fell to 24 percent below the competitive labor market in 2016. There were more than 4,000 fewer state employees in 2017 than in 2009.

- Overall, of 65 agencies funded with state appropriations, 39 are operating with at least one-fifth less state support than in 2009, without adjusting for inflation.

The Legislature took bold but partial steps last year to change direction after a prolonged period of shrinking investments in our public institutions. There is still a very long ways to go before we have restored our public resources to levels needed to build a thriving, prosperous state.

OKPOLICY.ORG

OKPOLICY.ORG

and as long as the state has corruption like this , Im very secpital that this state will ever recover from anything ! http://www.prowlingowl.com/OKTaxCom/1300MillionHiddenTaxCredits.cfm while the richests of the richest get away with this and Im sure the cucle will continue .