Download this fact sheet as a pdf here.

Oklahoma faces a large budget hole this year and a larger one next year.

- The state Supreme Court in August struck down a cigarette fee that was expected to provide $214 million in funding this year (FY 2018) to three health agencies – the Department of Mental Health and Substance Abuse Services, Oklahoma Health Care Authority (Medicaid) and Department of Human Services. This led Governor Fallin to call a special session that lasted 8 weeks from September to November.

- When the dust settled on special session, the three health agencies received enough funding to avert massive immediate cuts. But the agencies remain a combined $111 million short of initial FY 2018 funding levels, which continues the threat of major cuts later this year without additional funds.

- Along with the large remaining funding gap for the health agencies, this year’s budget now uses over $500 million in non-recurring revenue, which creates a substantial budget hole for next year.

- Gov. Fallin is expected to call a second special session aimed at approving permanent revenues needed to fill this year’s gap, set the budget on a sustainable path, and invest in key priorities.

State funding has been cut deeply in recent years.

- The initial FY 2018 budget of $6.848 billion was $20 million less than the final FY 2017 budget. This is $1.26 billion, or 15.6 percent, below the FY 2009 budget adjusted for inflation.

- Over half of all appropriated agencies (39 of 65) have seen their state funding cut by over 20 percent since 2009.

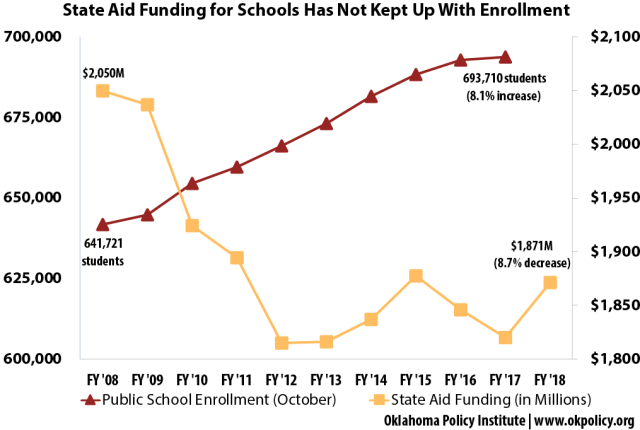

- State aid funding for public schools remains $179 million below FY 2008 levels, while enrollment has increased by over 50,000 students. Teachers have gone over a decade without an increase in the salary schedule, and school districts this year have issued over 1,800 emergency teaching certifications.

- State support for higher education has been slashed by $266 million – over 25 percent – since 2009.

- The state Medicaid agency has cut $445 million from provider rates and health care benefits since 2010, with an additional 6 percent cut for most providers scheduled for December 1st.

- More than 7,500 Oklahomans with developmental disabilities are on a waiting list for home- and community-based services.

- State government (excluding higher education) employs 11 percent fewer workers than seven years ago and 7 percent fewer than in 2001— despite population growth, heavier caseloads, and new mandates and responsibilities.

Budget shortfalls are a result of both economic factors and policy choices.

- Since 2004, the top income tax rate has been cut from 6.65 to 5.0 percent, resulting in annual lost revenues of $1.022 billion. When all tax cuts are considered, the annual revenue loss approaches $1.5 billion.

- Tax breaks on oil and gas production cost the state over $600 million in lost revenue in FY 2015, although several tax breaks for older production have since been repealed.

- Over the longer-term, Oklahoma will continue to face serious budget challenges due to an aging population, decaying infrastructure, economic transformations, and an outdated tax system.

OKPOLICY.ORG

OKPOLICY.ORG