Download a printable pdf of this fact sheet.

Oklahoma’s budget shortfalls continue despite revenue improvements.

- Lawmakers met in two special session in 2017-18 looking for ways to fill a $215 million hole budget hole that resulted from the Supreme Court striking down an unconstitutional cigarette fee passed last year.

- After failing to approve several comprehensive revenue proposals, lawmakers used some $170 million in one-time revenue to help fill this year’s budget hole while also cutting agency budgets by 2 percent for the four remaining months of FY 2018.

- Lawmakers will have $7.118 billion available to appropriate for FY 2019, which is $252 million (3.7 percent) more than current FY 2018 appropriations after cuts and supplementals.

- Revenue growth will fall well short of covering a variety of funding obligations for next year’s budget. These include making up for lost federal Medicaid funds for graduate medical education, shortfalls in the Ad Valorem Reimbursement Fund, increased bond payments, and increased corrections costs, as well as continued efforts to fund pay raises for teachers and state employees and address other longstanding priorities.

State funding has been cut deeply in recent years.

- The initial FY 2018 budget of $6.848 billion is $1.26 billion, or 15.6 percent, below the FY 2009 budget adjusted for inflation.

- Over half of all appropriated agencies (39 of 65) have seen their state funding cut by over 20 percent since 2009.

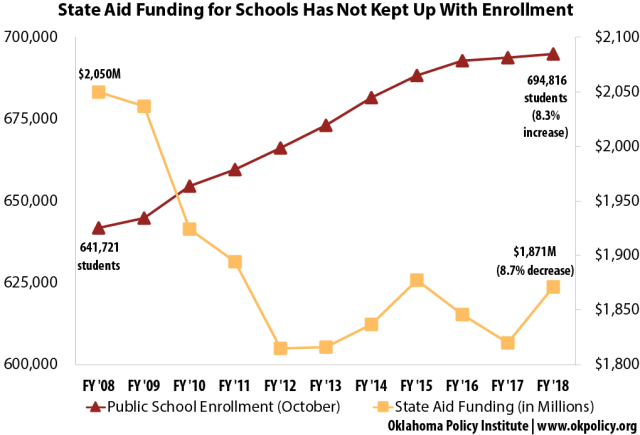

- State aid funding for public schools remains $179 million below FY 2008 levels, while enrollment has increased by over 50,000 students. Teachers have gone over a decade without an increase in the salary schedule, and school districts this year have issued over 1,800 emergency teaching certificates.

- State support for higher education has been slashed by $266 million – over 25 percent – since 2009.

- The state Medicaid agency has cut $445 million from provider rates and health care benefits since 2010.

- More than 7,500 Oklahomans with developmental disabilities are on a waiting list for home- and community-based services.

- State government (excluding higher education) employs 11 percent fewer workers than seven years ago and 7 percent fewer than in 2001, despite population growth, heavier caseloads, and new mandates and responsibilities.

Budget shortfalls are a result of both economic factors and policy choices.

- Since 2004, the top income tax rate has been cut from 6.65 to 5.0 percent, resulting in annual lost revenues of $1.022 billion. When all tax cuts are considered, the annual revenue loss approaches $1.5 billion.

- Tax breaks on oil and gas production are projected to cost the state over $325 million in FY 2019.

- Over the longer-term, Oklahoma will continue to face serious budget challenges due to an aging population, decaying infrastructure, economic transformations, and an outdated tax system.

Charts

OKPOLICY.ORG

OKPOLICY.ORG