Download the budget highlights as a pdf.

Download the budget highlights as a pdf.

OK Policy’s annual Budget Highlights issue brief is one of the most informative and accessible ways to track Oklahoma’s public spending. Today we’ve released the FY 2017 Budget Highlights, which includes a bullet point summary of the state budget, charts illustrating different aspects of the budget, and a table showing appropriations for every state agency going back to 2009. You can find more information and analysis about the state budget at our Budget & Taxes Issue Page.

Total appropriations for FY 2017 are $6.778 billion.

- Appropriations are $360 million (5.0 percent) less than the initial FY 2016 budget and $115 million (1.7 percent) less than the final FY 2016 budget after mid-year budget cuts and supplemental appropriations.

- Adjusted for inflation, the FY 2017 budget is $1.21 billion, or 15.2 percent, below FY 2009.

Most agency budgets will be cut deeper in FY 2017.

- 59 of the 73 agencies receiving state appropriations will see a further cut in FY 2017, on top of cuts absorbed in FY 2016 due to the mid-year revenue failures.

- Only 4 agencies will see an increase compared to their initial FY 2016 appropriations – the Oklahoma Health Care Authority, Tax Commission, Elections Board and Legislative Services Bureau. Four others are held flat – Department of Corrections, Corporation Commission, Court of Criminal Appeals and Commissioners of Land Office.

- The budget for the Legislative Services Bureau will grow by $9.3 million, or 205 percent. After accounting for cuts to the House and Representatives and Senate, the total legislative budget will increase by $4.1 million, or 11.5 percent, compared to FY 2016.

- Five agencies were held flat or will see an increase compared to their final FY 2016 funding – Human Services, Mental Health and Substance Abuse Services, the Indigent Defense System, Juvenile Affairs, and the Pardon and Parole Board. This is also the case for Common Education, excluding a FY 2016 supplemental to make up for a shortfall in the Ad Valorem Reimbursement Fund.

- Of the ten agencies receiving the largest state appropriations, Higher Education receives the deepest cut in FY 2017 – 15.9 percent compared to its initial FY 2016 funding.

More than half of all appropriated agencies – 39 of 73 – have now been cut by 20 percent or more since FY 2009, without accounting for inflation.

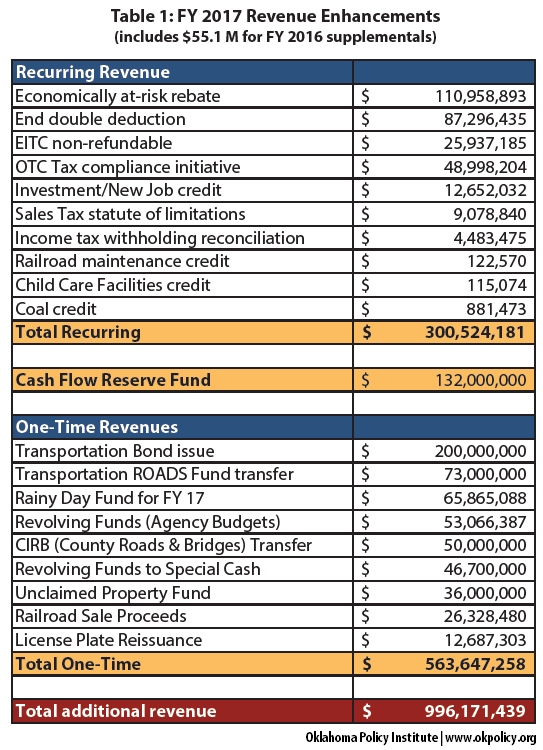

The budget includes almost $1 billion in additional revenue beyond the certified estimate.

- To the $5.851 billion certified by the State Equalization Board, lawmakers generated an additional $996 million for the FY 2017 budget.

- The main revenue enhancements were transfers from multiple funds ($391 million), eliminating or reducing various tax breaks ($237 million), transportation bonds ($200 million), and the Rainy Day Fund ($66 million).

- Of the $996 million in additional revenues, some $560 – $690 million consists of one-time revenues which will need to be replaced in developing the FY 2018 budget.

- Various recurring revenue options, including rolling back the income tax cut that took effect in January 2016, raising the cigarette tax or fuel tax, and broadening the tax base to services, were considered but not adopted.

Figures and Tables

OKPOLICY.ORG

OKPOLICY.ORG