Appropriations History

State appropriations vary based on economic and revenue growth. In years where the economy is strong, appropriations can grow a great deal. When the economy is weaker, revenues do not grow as fast and may decline, so spending does not grow as much, and may even fall. While citizens and elected leaders can address revenue fluctuations through tax increases, they have rarely done so.

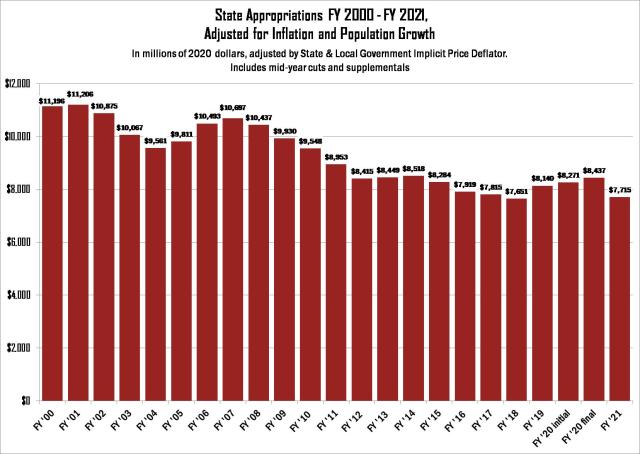

State appropriations have been cut repeatedly over the past decade: The state budget grew during the boom years of the mid-2000s and reached a peak of $7.125 billion in FY 2009. Then the onset of the Great Recession, coinciding with the full phase-in of income tax cuts passed in earlier years, led to a steep decline in state funding from 2010-12. Budget cuts would have been even more severe but for the availability of federal stimulus funds thought the American Recovery and Reinvestment Act, the state’s Rainy Day Fund, and various revenue enhancements approved by the Legislature.

Following the Great Recession, state appropriations grew for three consecutive years (FY 2013-2015), although their new peak of $7.235 billion was well below pre-recession levels when adjusted for inflation. Since 2015, the downturn in the energy sector, combined with further cuts to the top income tax rate and the continued cost of tax breaks, has led to two consecutive years of large budget shortfalls and cuts.

Higher petroleum prices, increases in the state gross production tax on those products, and other tax increases approved from 2016-18 raised state revenue to a new record (ignoring inflation and population growth) of $8.160 billion in FY 2020. However, the downturn resulting from the COVID-19 pandemic lowered the budget for FY 2021 and will likely do so for several more years absent further public investment through tax increases.

The chart below shows how a volatile economy and a long-term pattern of tax cuts has reduced the state’s ability to provide services. Due to inflation and population growth, the FY 2021 budget is 31 percent less than the budget for FY 2000.

For more information, see OK Policy’s FY 2021 Budget Highlights.

‹‹ Go back to Appropriations by Agency | Go on to Local Government Expenditures ››

OKPOLICY.ORG

OKPOLICY.ORG