As lawmakers continue to work to develop a plan to address the state’s budget crisis, the top priority has rightly been generating enough new revenue to avoid even more cuts to critical services and to fund longstanding needs like a teacher pay raise. At the same time, with tax increases on the table, we can’t lose sight of who is being asked to pay more. A good revenue plan must also ensure that everyone is contributing their fair share.

As lawmakers continue to work to develop a plan to address the state’s budget crisis, the top priority has rightly been generating enough new revenue to avoid even more cuts to critical services and to fund longstanding needs like a teacher pay raise. At the same time, with tax increases on the table, we can’t lose sight of who is being asked to pay more. A good revenue plan must also ensure that everyone is contributing their fair share.

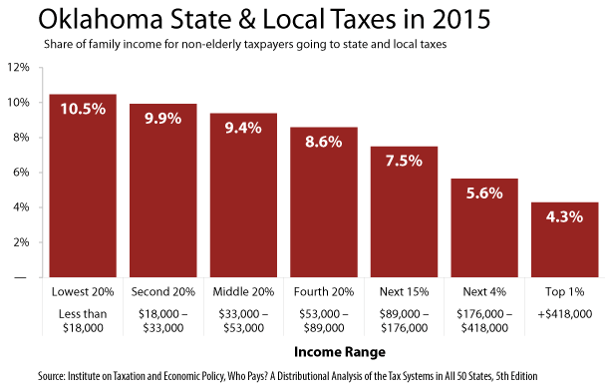

One of the most frequently overlooked features of our state’s current tax system is that it is regressive, which means that low- and middle-income families pay substantially more of their income in state and local taxes than do wealthier families. The median Oklahoma household with annual income between $33,000 and $53,000 pays 9.4 percent of their income in combined state and local taxes, while the wealthiest households with annual income over $176,000 pay under 6 percent, according to a 2015 analysis by the Institute on Taxation and Economic Policy (ITEP).

The overall regressivity of our state and local taxes is due to our heavy reliance on sales and excise taxes. Low- and middle-income households spend a much greater share of their income on taxable goods that are subject to the sales tax than do wealthier households, who save more and consume more untaxed services. Households in the lowest fifth in income pay an average of 8.0 percent of their income in sales and excise taxes, compared to just 1 percent for the wealthiest 1 percent, again according to ITEP.

The income tax, which assesses a higher rate on higher income earners, adds a measure of progressivity to our state tax system. Unfortunately, recent tax policy decisions have shifted our tax system in a more regressive direction. Since 2004, the top income tax rate has been slashed from 6.65 percent to 5 percent. The vast share of the benefit from cutting the top rate has gone to the wealthiest taxpayers. Nearly three-quarters (72 percent) of the benefit from those tax cuts has gone to households in the top 20 percent of incomes, compared to less than 10 percent going to those in the middle and lower income groups. Those in the bottom 40 percent of income have received less than $100 in average annual savings, while many have received nothing at all because none of their income is taxed at the top rate.

Meanwhile, in the past two years, the Legislature has made the tax code even more regressive by reducing two important benefits that help low- and middle-income families. In 2016, lawmakers slashed the state’s Earned Income Tax Credit by making it non-refundable. This $29 million tax increase amounted to a 75 percent cut in the EITC; a single mom with two kids working full-time for $10 an hour saw her taxes increase by over $200. This past session, lawmakers opted to freeze the standard deduction, which is claimed by more than three-quarters of all Oklahoma taxpayers and by over 85 percent of those earning under $75,000 per year, according to federal tax data. Since the mid-2000s, Oklahoma’s standard deduction had been coupled to the federal standard deduction, which is indexed to inflation. Freezing the standard deduction at its 2017 level is expected to raise taxes for those who claim it by $14.4 million in FY 2019, an amount that will rise every year.

In developing a revenue package to fill the budget hole and put state finances on more stable footing, we must keep tax fairness in mind. The main proposals being promoted by Republican leaders — raising the cigarette tax by $1.50 per package and increasing the excise tax on motor fuels — have policy merit. But both the cigarette tax and the motor fuel tax would have a greater impact on low- and moderate-income taxpayers than on wealthier households. To maintain balance and ensure that everyone is contributing to the cost of funding our public services, these taxes should be coupled with more progressive tax measures — some combination of a surcharge on high incomes, eliminating the deduction for Oklahoma capital gains, limiting itemized deductions, restoring the full Earned Income Tax Credit, and re-coupling the state standard deduction to the federal deduction so that it will grow in line with inflation.

Increasing Oklahoma’s revenues for core services is essential, but we have better ways to do it than putting the greatest cost on those families who can least afford it.

OKPOLICY.ORG

OKPOLICY.ORG

and the rich in this state and in our government , will make sure they pay the least affording tax payers to once again foot the bills .