Fairness is a fundamental tenet of most Oklahomans’ beliefs: People should get equal pay for equal work and kids should have equal opportunity to succeed. Unfortunately, the state’s current tax system does not reflect this priority. Rather, our tax system asks too much from low- and middle-income Oklahomans, while letting higher-earners off the hook. While discussions of tax reform have increased in recent months, they haven’t been focused on making the state’s tax system fairer. Instead, they have muddied the waters as the House swiftly passed a slew of conflicting bills – many of which would make our tax system even more lopsided – and the Senate has convened a partisan working group.

Good public policy depends on wide-ranging input and a transparent process. If lawmakers are serious about tax reform, they should invite a robust discussion that includes public and expert input. From there, we can strive towards a tax system that works for all Oklahomans, one in which everyone pays their fair share. A fair and adequate tax system would set us all up to succeed by asking the wealthiest Oklahomans to pay their fair share and providing a leg up to Oklahomans who need it.

Our current system hurts our state and economy

Oklahoma’s tax structure is regressive, which means it asks the most from those who can least afford to pay. The lowest-income Oklahomans – those making less than about $20,000 annually – pay more than double their share of taxes as a proportion of income than the wealthiest Oklahomans. The middle 60 percent of earners pay a significantly higher portion of their income than the wealthiest households, as well.

Our regressive tax structure has significant implications for Oklahomans, as well as the state’s economy. Because our system is so unbalanced, low- and middle-income earners have less money to spend on necessities and are missing opportunities to build wealth. And Oklahomans of color are disproportionately harmed by this lopsided system; because of historical practices like redlining and sanctioned discrimination in higher education that created huge imbalances in the housing and job markets, people of color remain overrepresented in lower-income brackets and more likely to be paid poverty wages.

The sum of these individual challenges creates an economy in which many people can’t fully participate. If Oklahoma’s tax system was fairer, low- and middle-income families would have more after-tax income to spend, and they would spend most or all of that locally. (Conversely, wealthy individuals save a higher portion of their money than most other families, and therefore contribute less to local economies.) But because our tax system asks the most from those with the least ability to pay, too many Oklahomans are unable to fully contribute to and participate in their local economies. This casts ripples throughout communities as small businesses have fewer customers and families have unmet needs.

A fairer tax system would do several things…

Ask more from those who can afford to pay.

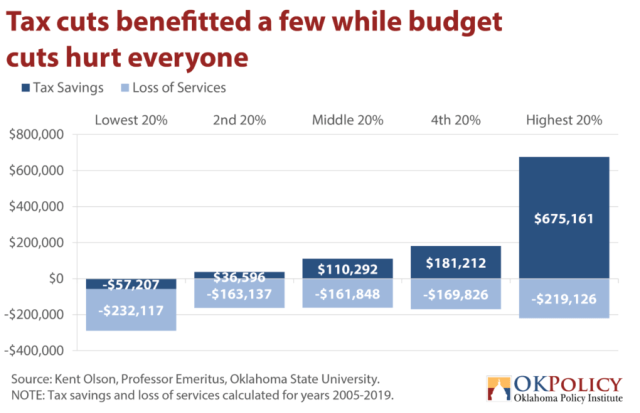

To design a fairer tax system, Oklahoma must reverse the trend of shifting the tax burden from higher earners to lower-income Oklahomans. This shift is largely due to reductions in income tax rates, elimination of the estate tax, and tax increases on items like cigarettes that disproportionately impact lower earning residents.

Those who have benefited most from tax changes – the wealthiest Oklahomans – can afford to contribute more to the state’s shared resources and have a responsibility to our shared prosperity to do so.

- A true graduated income tax would help mitigate the regressivity of the rest of the tax system because it taxes higher incomes at higher rates, but Oklahoma’s personal income tax rate isn’t graduated enough to achieve that goal. Adjusting the top income tax rate from 4.75 percent to six percent for the highest-income Oklahomans (joint filers making $300,000 annually, and single filers making $150,000) would offset some of the regressivity of our tax system.

- Reinstating the estate tax would level the playing field between those who work for a living and those who generate income from wealth. The tax was repealed in 2010, despite the fact that the tax applied only to estates worth more than $3 million. Reinstating the tax would shift some of the tax burden away from working Oklahomans.

- Repealing the Capital Gains Deduction would also create a fairer tax system. With nearly all of the benefits going to Oklahomans making more than $200,000 annually, the Capital Gains Deduction skews our tax system towards the wealthiest. If outright repealing this deduction isn’t feasible, good alternatives could include limiting the deduction to the farming industry, small businesses, or individuals making below certain income levels.

Require wealthy corporations to pay what they owe.

The presence of the corporate income tax is one of the fairer aspects of Oklahoma’s tax system, as its burden primarily falls on wealthy shareholders. Further, in Oklahoma, the corporate income tax largely affects large and out-of-state corporations, as most small businesses pay taxes through the personal income tax. Oklahoma lawmakers cut the corporate income tax from six to four percent in the 2021 legislative session, and the House has since pushed for a complete phase-out, despite the fact that an elimination would overwhelmingly benefit wealthy, out-of-state corporations over Oklahoma-owned small businesses. Large corporations rely on Oklahoma’s roads, schools, and hospitals, and they should contribute to the upkeep and provision of these services.

A fairer tax system would ask more from wealthy corporations:

- Raising the corporate tax rate back to six percent would return about $110 million annually to the state, with the funds coming largely from well-paid executives and shareholders.

- Repealing several corporate tax incentives – such as the film enhancement rebate and the many incentives for oil and gas production – would require corporations to pay what they owe, rather than subsidizing wealthy corporate executives at the expense of their employees.

Support working Oklahomans.

State taxes should set all Oklahomans up to succeed – not tax them deeper into poverty. By asking more from those who can afford to pay and requiring corporations to pay what they owe, the state can better help working Oklahomans. One of the best ways to support low- and middle-income families is by strengthening targeted tax credits, which levels the playing field and ensures all residents can thrive.

- The Sales Tax Relief Credit (STRC) helps low- and middle-income households offset the cost of the most fundamental need: groceries. Set at $40 per person in 1990, the credit amount has never been updated and has lost 60 percent of its buying power due to inflation. Oklahoma’s heavy reliance on sales tax is a significant part of our regressive tax system, so increasing the credit’s amount and increasing the income limits to qualify for the credit would go a long way towards making our tax system fairer.

- The Earned Income Tax Credit (EITC) supports working families and reduces poverty. At five percent of the federal credit, Oklahoma’s state credit is relatively small; only two states have smaller credits. In 2018, the EITC helped more than 300,000 Oklahoma families put food on the table, replace a tire to get to work, or save money for the future. Expanding the credit would make Oklahoma more competitive with other states and increase hundreds of thousands of Oklahomans’ incomes.

- A tax credit for renters would ease the tax burden for individual renters and make our tax system fairer. Oklahoma homeowners qualify for a homestead exemption from property taxes, but there is no similar assistance for people who rent their homes, even though they indirectly pay property tax as a part of their rent. Renters face greater financial uncertainty than homeowners, and are more likely to struggle to afford basic necessities.

Protect our revenue base.

Passed in 1992, State Question 640 makes it virtually impossible for Oklahoma to raise state revenue when necessary, because it requires a three-fourths majority of both legislative chambers or a majority vote of the people. Since its passage, the Legislature has met this requirement once, in response to the 2018 education rallies. Any meaningful discussions of tax reform must include the repeal of SQ 640 or a requirement that lawmakers meet the same threshold when cutting revenue.

Let’s create a tax system for all of us

Amid discussions of comprehensive tax reform, Oklahoma leaders have an opportunity to level the playing field and set everyone up for success. Our tax system should be fair and adequate; it should ask the most of those with the most to give, and it should fully fund state needs. Oklahoma’s tax system doesn’t currently meet either of those requirements. By asking more of those who can afford to pay, requiring wealthy corporations to pay what they owe, and supporting low- and middle-income Oklahomans, we can reach those goals.

To support fair and common-sense tax reform, contact your legislators and ask them to create a tax system that works for all Oklahomans.

OKPOLICY.ORG

OKPOLICY.ORG