Now that the state’s economy and budget outlook are improving, lawmakers are considering a substantial state tax cut. House Bill 2041 — by House Speaker Charles McCall, R-Atoka, and others, and Sen. Julie Daniels, R-Bartlesville — would reduce the state’s individual income tax starting in tax year 2022 (for returns due in April 2023).

While this bill provides long-needed refunds to some low-income taxpayers, more than half of tax cuts would go to higher income Oklahomans who can afford to pay the current rate. Along with HB 2083, which would eliminate the state corporate income tax, state revenue could be reduced by 7.5 percent. This would shrink our economy and speed up the reduction of public services that has continued throughout this century.

Lawmakers should set aside both of these bills and have a broader discussion about whether it’s more important to broadly cut taxes than to provide public services, invest in our state’s future, save for the next economic downturn, or provide better-targeted tax reduction.

HB 2041 restores refundability of the state’s Earned Income Tax Credit, but is much broader

HB 2041 makes three changes in the individual income tax. (In case you aren’t clear on income tax terms and calculations, our Online Budget Guide walks through the steps.)

- It reduces all tax rates by 0.25 percentage points. The top rate would be reduced from 5.00 percent of income to 4.75 percent, and everyone who pays income taxes would see a proportional reduction.

- It eliminates the personal exemption for single taxpayers with gross incomes over $100,000 and married taxpayers with incomes over $200,000, which would increase their taxes by $50 per person in the household.

- Finally, it makes the state Earned Income Tax Credit (EITC) refundable so that taxpayers would receive the full credit even if they owed no income tax. This would lower taxes for more than 200,000 working families.

In the first full year, HB 2041 would reduce state revenue by nearly $189 million for a full fiscal year (about 2.5 percent of the $7.7 billion budget for the current fiscal year).

Oklahomans who need economic help would benefit from HB 2041, but so would those who don’t

Tax rate reductions grow with income, so those with high incomes would see the biggest tax cuts. Households making more than $90,000 make up 20 percent of Oklahoma taxpayers but would receive 54 percent of the tax reduction. However, EITC refundability does provide significant tax benefits to low-income working families. The chart below shows savings by income level for a single parent of one child. With a $15,000 income (equivalent to working full-time at the minimum wage and still below the poverty level for a family of two), the family would see an additional $166 tax refund. The benefits of HB 2041 would be smallest for the middle-income families, who make up the majority of taxpayers. You can see charts for a childless adult and a married couple with two children here.

Economic uncertainty makes expensive tax cuts premature

When the Oklahoma House of Representatives debated HB 2041, several members noted the budding economic recovery and the growth in state revenue. They argued it’s the appropriate time to share the bounty with taxpayers, but that thinking is premature for several reasons.

The economy is better than it was a year ago, but that doesn’t mean it has recovered. Right now our economy is like a two-year-old on a sugar high, but we know the high won’t last. This recovery is driven by record federal spending. It also may be fueled by “pent-up demand” from those who were able to save through the COVID-19 pandemic and feel safer to spend money. However, that effect could be short-lived, as it was after the pandemic a century ago. Indeed, the Federal Reserve recently forecast that after this year’s 6.5 percent economic growth, we’ll return to normal growth rates of roughly 2 percent by 2023. That means what could look like excess revenue today won’t be there when HB 2041 would have its full impact on state revenues.

There are other reasons to think this year’s state revenue recovery won’t last long. The revenue forecast for the fiscal year starting this July includes more than $1.3 billion in one-time revenue and more than $100 million borrowed from retirement systems for teachers and law enforcement personnel that must be repaid starting July 1, 2022. Even with modest revenue growth, the FY 2023 budget will probably be smaller than the FY 2020 one was, so we should be cautious about cutting revenue further.

Before cutting taxes, consider the alternatives

House Speaker Charles McCall, sponsor of HB 2041, indicated he was introducing this and other tax cut bills to start a dialogue. That’s a great idea, but only if the dialogue is open, deliberative, and considers all alternatives. Several questions should be addressed in any such dialogue.

First, does it make sense to cut taxes just three years after lawmakers had to increase taxes by more than a half billion dollars to better fund our education system? It certainly does not, since per pupil state spending on education is still $1,300 less than in FY 2008, adjusted for inflation. Since common education makes up 39 percent of the budget, it will be very difficult to protect school spending while cutting taxes.

Second, is our current budget really sufficient to support the state we want to be? We spend less now on virtually every service than we did 20 years ago, and we aren’t even discussing investments that would build the state’s economy and communities, like early childhood programs, mental health and substance abuse treatment, and job training at all career levels.

Third, shouldn’t we restore the state’s savings we spent to maintain core services through the pandemic? The balance of the state’s two major savings funds is now just $229 million, or four percent of the General Revenue Fund, down from $1 billion just a year ago. Our current savings won’t sustain us through even a minor economic slowdown or drop in petroleum prices, and we should not cut taxes until we have enough saved to do just that.

Fourth, to whom should the tax relief be targeted? The COVID-19 recession has not hit all families equally. In Oklahoma, jobs paying greater than $60,000 have almost fully recovered. By contrast, middle-wage employment is down by four percent, and low-wage (under $27,000) employment is still down by more than 20 percent compared to pre-pandemic levels. With this in mind, any tax benefits should go towards the families who need it, which can be accomplished by increasing Oklahoma’s EITC rather than decreasing our top income tax rate.

Well-targeted tax relief is also a good stimulus for the economy as a whole. This is because low-income families tend to immediately spend relief money on the things they need — which tend to be goods and services — in their local economies. When high-income families receive financial relief, however, they are more likely to save rather than spend it, which does little to boost the economy. Since high-wage jobs have already recovered, there is little promise that tax relief will boost spending in high-income families.

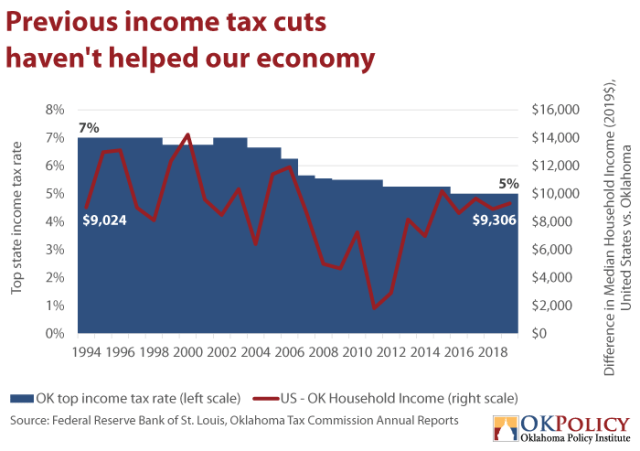

Finally, why should we repeat the same strategy that’s already failed us and other states? Since 1999, Oklahoma has cut the top income tax rate from seven to five percent, at a cost of more than $1 billion in public services.

There’s little evidence that tax cuts boosted the state’s economy. If they had, one would expect Oklahoma’s income to start catching up to the national average. The chart below shows that did not happen. Oklahoma’s median income is still $9,000 below the national median, just as it was in 1994, before cutting the top income tax by two full percentage points (a 40 percent reduction). Other factors, like the national economy and oil gas prices, probably had more impact on our economy than state taxes did.

Nor is Oklahoma’s experience unique. In fact, in the decade leading up to 2016, economic growth was higher in the nine states with the highest income tax rates than it was in the nine states without income taxes. If we want to spur our economy, we should look somewhere besides tax cuts.

Someday it could make sense to reduce the state income tax, but not today and not this way

Oklahoma has a history of erratic revenues along with badly timed and poorly aimed tax cuts. We can and should have a discussion about tax cuts that would be well-targeted and economically effective without reducing our core education, health, public safety, and infrastructure functions. However, we should put that discussion on hold until we restore funding for these functions to the levels we need and start making smart investments in the programs and services that will help Oklahoma thrive.

Advocacy Actions:

- Contact your legislator to urge them to vote NO on HB 2041, which is now being considered by the Senate. [Find Your Legislator]

- Sign up for alerts and communications from OK Policy and Together Oklahoma

Scenarios: HB 2041 reduces taxes most for the lowest and highest income households

Single adult with no children

Married couple with two children

Josie Phillips, policy intern, assisted in researching and writing this article.

OKPOLICY.ORG

OKPOLICY.ORG