[Download this report as a pdf] | [See charts]

The FY 2022 budget reverses service cuts but remains at among lowest level in decades

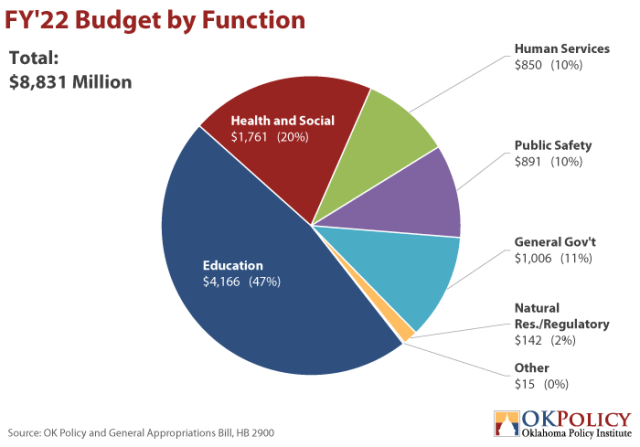

- For the budget year beginning July 1, 2021 (FY 2022), state agencies will have $8.83 billion to spend.

- This budget is $2.4 billion (22 percent) below the 2000 budget when adjusted for inflation and population growth, meaning Oklahomans have one-fifth less services than 21 years ago (Figure 1).

- In addition, the budget bill adds $234 million in supplemental funding for the current fiscal year (FY 2021) to bring total spending of $9.06 billion this legislative session.

- The FY 2022 budget leaves approximately $880 million unspent to restore savings for future needs.

The budget reflects a dramatic, if short-term, turnaround from last year

- In current dollars, the FY 2022 budget is the largest in state history and represents a 14 percent increase over the original, pandemic-affected budget for the FY 2021 budget year, which started July 1, 2020. (Figure 2).

- The FY 2021 budget, however, was a three percent reduction from the prior year.

- The increase for FY 2022 results from an economic uptick as the pandemic recedes, and an unprecedented flow of federal relief for families, businesses, and governments.

- Future budget growth will depend on continued federal investment, economic growth that extends beyond short-term post-pandemic consumer spending, and a strong recovery in the petroleum sector.

Tax cuts will have long-lasting impacts

- The FY 2022 budget includes a reduction in the corporate income tax and the banking privilege tax, with both being reduced from 6 percent to 4 percent. These cuts will cost the state $53.9 million in FY 22 and $110.2 million every year after that when reductions are in effect for a full budget year.

- The budget also decreases the individual income tax by 0.25 percent for all taxpayers, which will cost $83.1 million in FY 22 and $236.7 million per year in future years.

- Taken together, these cuts will reduce the state’s revenue by $346.9 million annually, or about 4 percent of the current budget. Because of State Question 640, these cuts can only be overturned with a three-fourths majority vote by both chambers of the Legislature or a majority vote of the people. Oklahoma has only increased revenue twice since SQ 640 was passed nearly 30 years ago.

The budget includes some other tax provisions

- Oklahoma’s Earned Income Tax Credit (EITC) will be made refundable again in FY 2022, meaning that low-wage workers will be refunded the remaining balance of the credit after paying their tax bills. The budget also decouples the state EITC from the federal one, meaning the state credit will no longer be indexed to inflation. This means the actual buying power of the credit will decrease over time unless this is addressed with future legislation.

- The cap on the Equal Opportunity Education Scholarship will be increased tenfold from $3.5 million for private schools and $1.5 million for public schools, to $25 million annually for each. Donations to public school foundations are also now eligible for this credit. This could cost the state an additional $45 million annually.

- Lawmakers increased other tax incentives, including a tax rebate for companies that expand broadband access in underserved areas (capped at $42 million for two years), an expansion of the film production incentives (costing $30 million annually), and a sales tax exemption for the University Hospitals Trust (costing about $7 million annually).

Recent education cuts are partly reversed in this budget

- Spending for all education agencies makes up 47 percent of the state budget, or $4.2 billion.

- Lawmakers increased the budget for common education (prekindergarten through 12th grade) by $173 million (5.7 percent) to $3.16 billion (Figure 6).

- The budget increases funds sent directly to schools through the school funding formula by $136 million (3 percent). When adjusted for inflation, formula per student returned to the FY 2020 level but is 16 percent below FY 2008 level (Figure 5). As a result of this disinvestment, we spend less per student than any state in our region and exceed only Idaho and Utah nationally.

- The budget for higher education increased $42 million (5.5 percent), reaching the highest level since FY 2016. The budget for this key driver of economic growth remains 21 percent below its 2009 level (Table 1).

- The budget for Career and Technology Education increased only one percent, in spite of high demand for retraining in the wake of the pandemic.

Medicaid expansion will make Oklahomans healthier, but we have work to do, especially in mental health

- Health and social services agencies receive $1.76 billion, which represents one-fifth of the budget.

- The Oklahoma Health Care Authority (OHCA), which manages SoonerCare, Oklahoma’s Medicaid program, received a $194 million (19 percent) budget increase. Lawmakers funded Medicaid expansion, with federal American Rescue Plan Act (ARPA) funds and an increase in fees charged to hospitals that will rise gradually as federal funds are spent. The budget also increases OHCA funding for program growth ($29 million), expanded dental coverage for adults ($17 million), and alternative treatments for pain management ($8 million). Finally, OHCA received $164 million to deposit in the Rate Preservation Fund, which protects SoonerCare from service cuts should the federal share of Medicaid go down.

- The budget for the Department of Mental Health and Substance Abuse Services was reduced by $13 million, or 4 percent. However, additional federal funds from Medicaid expansion will allow the Department to fund program growth, crisis intervention training and mobile crisis teams, connectivity between law enforcement and mental health providers, and contracts to transport persons experiencing mental health crises for assessment or detention, a function currently carried out by law enforcement officers. While lawmakers described these investments as complying with State Question 781, they did not explicitly follow its requirements to make an appropriation to the County Community Safety Investment Fund for community mental health and substance use disorder treatment. State Question 781 requires the state to invest justice reform savings (from SQ 780) into that fund; OMES has calculated that SQ 780 saved more than $10 million last year.

- The budget of the University Hospitals Authority has been increased by $20 million, half of which lawmakers have said will establish a new children’s mental health program. This falls far short of our state’s need to support all our children in overcoming mental health challenges from the pandemic.

This budget makes a modest investment in public safety

- Funding for public safety agencies accounts for about 10 percent of the budget, or $891 million. This is a 5.4 percent increase from last year.

- The Department of Corrections received an additional $13 million to improve the ratio of correctional officers to inmates, treat Hepatitis C in inmates, and improve information systems.

- The budget only slightly increases appropriations to the District Courts, which forces our court systems to rely on fines and fees rather than appropriation. This funding issue continues to disproportionately harm Oklahomans of color and low-income communities.

- The appropriation for the Oklahoma Indigent Defense System will also increase by $3 million (17.3%), which is a welcome and necessary investment in our justice system.

Lawmakers missed an opportunity to invest in the needs of Oklahomans

- Human services agencies also receive about 10 percent of the budget, or $850 million, which represents a 0.7 percent increase this year.

- The Department of Human Services will see a 0.5%, or $3.8 million increase. Of this, $2 million will be used to help reduce the waiting list for services for individuals with intellectual and developmental disabilities.

- The Legislature has also directed DHS to conduct an assessment to determine the actual size of the waiting list and made a verbal commitment to fully addressing the waiting list in next year’s legislative session. This year, the Legislature introduced and passed (within six days) House Bill 2899, a bill that would require individuals in need of services to live in Oklahoma for five years before applying for and being placed on the waiting list. While addressing the waiting list is vitally important, this likely unconstitutional bill doesn’t actually do that — it just makes it longer for some applicants.

- The budget for the Office of Juvenile Affairs will increase slightly, by $1.5 million (or 1.6%), and the Department of Rehabilitation Services’ budget will remain flat.

The budget will improve Oklahoma’s infrastructure, environment, and facilities

- The Department of Transportation (DOT) will see an increase in spending due to the Rebuilding Oklahoma Access and Driver Safety (ROADS) Fund. The budget authorizes DOT to spend $575 million from the ROADS Fund, in addition to its general appropriation of $187 million. In previous years, OK Policy has not counted ROADS funds as part of the DOT budget, but doing so portrays a more accurate picture of what the state spends on transportation.

- The budget increases appropriations to the Department of Agriculture by $4.5 million (17 percent) and specifies that the agency invest in several Oklahoma State University programs and hire additional meat inspectors.

- The budget includes $15.5 million (a $2 million increase) for the Rural Economic Action Plan (REAP), which funds water and other infrastructure improvements.

- The budget also increased investment in environmental protection through the Conservation Commission (8.4 percent increase), Department of Environmental Quality (25.6 percent increase), and the Water Resources Board (38.4 percent increase).

This budget also makes several one-time allocations. These can be found in FY 2021 Final column of Table 1, since the money can be spent immediately

- State Emergency Fund: $5 million

- Quick Action Closing Fund: $20 million

- Multiple Injury Trust Fund: $11.5 million

- County Improvement for Roads and Bridges: $20 million

- Maintenance of State Buildings: $7.5 million

- Opioid Abatement Revolving Fund: $10.2 million

- State-Tribal Litigation Fund to address issues arising from the Supreme Court’s McGirt decision: $10 million.

- Several state agencies received supplemental funding for FY 2021 for a variety of purposes, including $109 million to the State Department of Education to reimburse schools for property taxes lost due to business incentive programs, $15 million to the Department of Commerce for a business incubator, $10 million to the Office of Management and Enterprise Services for improved security for the Capitol and Governor’s Mansion, $7.5 million to the District Courts to replace uncollected fines and fees, and $6.6 million to the Department of Public Safety for expediting REAL ID driver’s licenses and identification cards.

We’ve turned the corner, but where’s the gas pedal?

The FY 2022 budget is a welcome reversal both from the long-term decline in funding for services and the impact from last year’s state budget that was reduced due to uncertainties about the emerging pandemic. Several questions remain:

- How long will the recovery last? This is a particularly important question since reversing tax cuts could require a three-fourths legislative vote under SQ 640. Our leaders can prepare for a downturn by examining tax expenditures like exemptions, deductions, and incentives. Lawmakers can increase revenue by reducing or eliminating these measures with a simple majority vote.

- Will our state and local governments use the funds they receive under ARPA wisely to help people and businesses recover from the pandemic and prepare for the future?

- When will legislators catch up to voters in taking criminal justice reform seriously? Future budgets should fully fund courts so that they are not dependent on excessive fines and fees. Lawmakers should explicitly follow SQ 781’s requirements to invest justice reform savings into community mental health and substance use disorder treatment, as demanded by Oklahomans in 2016.

- Why do we have one of the nation’s least transparent budget processes, rather than giving all Oklahomans a say in how our tax money is spent?

- When will we invest in our people and places instead of trying to lure businesses into the state with expensive and ineffective tax breaks? The way to a strong economy and thriving communities and people is through investment in education from birth through college, building workers’ skills, making broadband universal and affordable, providing the health care everyone deserves and needs, and true tax reform. Until we do that, any state budget is, in part, a lost opportunity.

Budget Highlights Charts

Figure 1

Figure 2

Figure 3

Figure 4

Figure 5

Figure 5

Figure 6

Figure 7

Figure 8

Paul Shinn, Budget and Tax Senior Policy Analyst, contributed to this article.

OKPOLICY.ORG

OKPOLICY.ORG