Whenever advocates argue for stronger regulation of payday loans or for preventing the introduction of new high-cost loans, defenders of the high-cost loan industry commonly argue that without these products, Oklahomans would either turn to loan sharks or be left without any way to cover their unexpected expenses.

Yet numerous states have much stricter rate caps and other regulations on payday loans than Oklahoma, and families in those states are not running to loan sharks. If Oklahoma were to restrict payday loans, will low-income families be left without any legal way to pay their bills?

The short answer is no. Aggressive marketing by predatory lenders convince many families that high-interest loans are their best option, but in fact these loans strip wealth from families and throw them into a cycle of debt that can be impossible to break. Before payday lenders existed, families had other ways to cover unexpected expenses as well as recurring expenses when their income fell short. If predatory loans are banned in Oklahoma, these alternatives are ready to fill the gap.

Why this matters now

The Consumer Financial Protection Bureau is developing new rules to regulate high-cost, small-dollar payday loans. The payday loan industry has tried to avoid this regulation by seeking approval for a new type of high-cost loan called a “flex loan.” Flex loan legislation has been introduced in several states, but so far has gained passage only in Tennessee. In Oklahoma, a bill to allow flex loans for up to $3,000 with a 240 percent APR was introduced in 2016 as SB 1314, and passed out of a Senate committee. The bill’s author, Sen. David Holt, withdrew the bill after many religious leaders and advocates for the poor spoke out against it. Although this bill did not make it to the Senate floor, the language could appear in another bill this session or in future years.

What are the alternatives to payday loans?

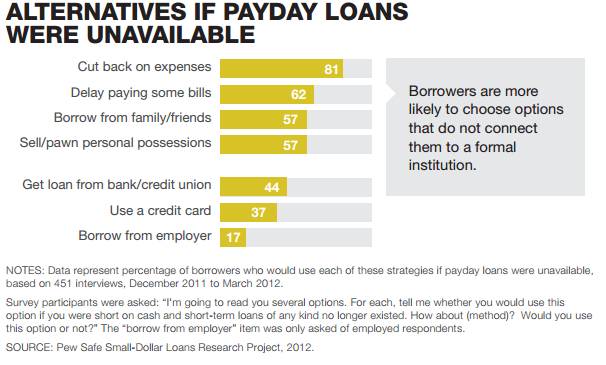

When payday loans are no longer an option, borrowers surveyed by the Pew Charitable Trusts reported that they would seek out a variety of other options, including cutting back on expenses, delaying payment of some bills, borrowing from family and friends, or pawning/selling possessions. In addition to these common sense alternatives, families can seek out a variety of programs that will help them manage their finances without sinking into a debt trap.

The alternatives consumers choose is related to the needs they have. For example many payday loan users report the reason for borrowing is to pay off credit cards or other debt. If predatory loans weren’t such a superficially easy option, borrowers would be more likely to seek out credit counselors who can work out a debt repayment plan with creditors or help to develop a budget. Many nonprofit credit counseling services are available at little or no cost, and they are located all over the state. When paying creditors and utility companies, another alternative to predatory lending is for consumers to deal directly with their debt. Consumers can set up payment plans to give themselves more time to settle debt. By working with consumer counseling organizations, borrowers can get tips on the best ways to work with creditors.

What about emergency loans?

[pullquote] Alternative options may not be as convenient or heavily advertised as a high-cost payday loan, but at the end of the day borrowers would be much more financially secure.[/pullquote]

Although the payday loan industry claims that their consumers use payday loans for emergencies, most consumers use them for recurring expenses. In Oklahoma, a majority of payday loan consumers take out 12 to 40 loans a year and only 5.4 percent took out 3 or fewer loans in a year, according to the state’s Deferred Deposit loan database. This data shows consumers are dependent on the loans to provide assistance nearly all year.

Still, emergencies do arise, and when they do, there are emergency assistance programs. Many churches, faith-based groups, and community organizations provide emergency assistance, either directly or through social services programs. These operations range from general to specific in what areas of need they cover. They may cover a specific type of bill, only cover residents in a particular neighborhood, or have a limit to how many times a year the will offer assistance. These services are particularly important because payday loan consumers report that 69 percent of first time payday loans are for recurring expenses such as food, rent, or utilities.

If a family can’t avoid borrowing, other options are available

While most consumers would choose to seek out options where they do not borrow, there are still borrowing options available. Some said they would still seek a loan, but they would obtain it from a bank or credit union, use a credit card, or borrow from an employer. Credit unions have responded to the predatory lending crises with personal loans to consumers. Some credit unions require you to already have an account with them to take out a loan, but many do not. These credit unions’ small dollar, short-term loans are offered at a reasonable rate with longer repayment periods and installment payments. Some credit unions in Oklahoma offer rates between 6 and 16 percent.

Military families have another lending option. Since the passage of the Military Lending Act in 2007, loan companies cannot charge active duty military an annual interest rate over 36 percent for some consumer loans, including payday loans. These military loans range from 32 to 34 percent APR. Several companies offer loans ranging from $500 to $10,000 to active duty and retired military personal.

The Bottom Line

Many borrowers continue to end up with high-cost loans despite these better lending options because payday lenders target less informed consumers in their advertising. There is also evidence to show some lenders are targeting minority consumers. Alternative options may not be as convenient or heavily advertised as a high-cost payday loan, but at the end of the day borrowers would be much more financially secure.

The best alternative to high cost, predatory personal loans is in the hands of the legislators who bemoan the lack of alternatives to payday lending. Though it does not exist yet in Oklahoma, many states have moved to cap the allowed interest on small dollar loans. A 36 percent rate cap on all payday loans would allow for payday loans to exist without creating a debt trap for hard working Oklahomans.

OKPOLICY.ORG

OKPOLICY.ORG