Editor’s note: This piece was published during the 2022 regular session and references specific bill numbers that lawmakers considered before legislative deadlines. While these bills did not pass the final legislative deadlines, the core principles of these bills — and even specific language from these bills — could appear in future legislative discussions and bills.

Leaders of both political parties have discussed the possibility of eliminating the state sales tax on groceries this legislative session. While the sales tax on groceries is regressive and should ultimately be addressed through comprehensive tax reform in Oklahoma, the state is not in a position to implement this change this year. Eliminating the state sales tax on groceries will cost the state crucial revenue, and potential increased pressure on cities to also remove local grocery sales taxes could jeopardize a significant revenue source for municipalities. These cuts would harm the ability of both our state and local governments to deliver the shared public services all Oklahomans use. To avoid this, lawmakers should consider significantly expanding the Sales Tax Relief Credit that would provide targeted tax relief to Oklahomans who need it, cost less revenue, and give lawmakers more flexibility to raise revenue in the future.

Eliminating the sales tax on groceries will cost critical revenue now and in the future

Cutting the state’s portion of the sales tax on groceries would cost Oklahoma between $235 million and $306 million annually. To put that into perspective, that’s almost as much as the state’s entire appropriation to the Department of Mental Health in the current fiscal year that started June 30, 2021. Losing this much revenue could have a tangible impact on the state’s ability to provide the shared services on which all Oklahomans rely. Efforts at tax reform will be much less effective in helping working Oklahomans if the lost revenue reduces the state’s investment in essential programs like public education, roads and bridges, and mental health care.

Further, this significant policy change would leave the state particularly vulnerable as state revenues return to normal levels after this year’s “rosy fiscal picture” that can be greatly attributed to the influx of federal pandemic relief dollars. If lawmakers were to eliminate the grocery sales tax, it would be difficult to replace that lost revenue in the future due to the state’s requirement that revenue-raising bills be approved by a three-fourths majority of both legislative chambers or a vote of the people. Since State Question 640 passed in 1992, voters have passed tax increases on charity games, tobacco, and medical marijuana and created a lottery, but the Legislature has only passed one major revenue-raising bill, which was during 2018’s education rallies at the Capitol. Conversely, the state has faced nine revenue failures since the year 2000, five of which have been since 2016. Taken together, this should serve as a warning: once a tax is removed, it is extremely difficult to reinstate it, even in the midst of a fiscal crisis.

Most of the current bills that would exempt groceries from the sales tax — including Senate Bill 1495 from President Pro Tem Sen. Greg Treat and House Bill 3621 from Minority Leader Rep. Emily Virgin — only include the state tax, leaving the local sales tax intact. However, exempting groceries from the sales tax at the state level could open the door to future erosion at the local level, as residents push for further reductions or similar. Talk of eliminating the grocery sales tax has already caused widespread confusion on the details of the proposal, and cutting the tax at the state level may increase local appetite for reducing or eliminating the local tax. As the sales tax is cities’ main source of income, any erosion of local sales taxes would significantly impact municipalities’ abilities to adequately fund police, fire, utilities, street maintenance, and city parks and recreation.

To provide more targeted tax relief, expand the Sales Tax Relief Credit

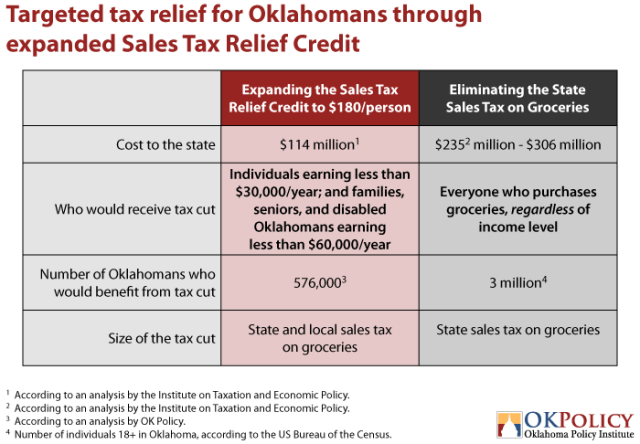

What should not be lost in this discussion is the need for targeted tax assistance for working Oklahomans, who have been the hardest hit by rising prices. State lawmakers can provide this targeted relief by expanding the Sales Tax Relief Credit, a credit meant to offset the cost of the sales tax on groceries for lower-income Oklahomans. By expanding this existing credit from $40 per person to $180 per person and adjusting the income limits to include a phase-out of the credit for higher-income households, lawmakers can substantially reduce or eliminate the state and local sales tax on groceries for low- and moderate-income families. This would also have a smaller price to the state.

Notably, expanding the credit will give future lawmakers much more flexibility. Whereas a three-fourths majority is needed to raise tax rates, no such requirement exists to increase or decrease tax credits. Adjusting the credit instead of eliminating the tax will provide an easier avenue to raise revenue for core services in the future when the state faces an inevitable economic downturn.

It is time for a broader discussion of tax policy in Oklahoma

Ultimately, eliminating the sales tax on groceries is a worthy goal. Doing so would make Oklahoma’s tax system less regressive and more fair for everyone, particularly lower-income taxpayers. However, due to state leaders’ propensity for cutting taxes and simply adjusting budget expectations rather than re-raising that revenue when necessary, doing away with the tax may do more harm than good. Until state leaders engage in a meaningful discussion about comprehensive tax reform — a discussion that includes diversifying municipal revenue streams, addressing the state’s structural deficit, and revising the State Question 640 requirements — outright reducing any taxes this year could set the stage for unsustainable revenue loss and further cuts to core services during the next economic downturn.

Oklahoma cannot afford to lose up to $306 million annually with little chance of re-raising that revenue when it becomes necessary. A strengthened Sales Tax Relief Credit offers a reasonable and fiscally responsible alternative for targeted tax relief for working Oklahomans. While HB 3622 would double the existing credit to $80 per person, a larger expansion would provide more meaningful relief to those who really need it. Until Oklahoma leaders are ready for a discussion about comprehensive tax reform, strengthening the Sales Tax Relief Credit remains the best and most fiscally responsible option to provide relief from the sales tax on groceries.

Oklahoma cannot afford to lose up to $306 million annually with little chance of re-raising that revenue when it becomes necessary. A strengthened Sales Tax Relief Credit offers a reasonable and fiscally responsible alternative for targeted tax relief for working Oklahomans. While HB 3622 would double the existing credit to $80 per person, a larger expansion would provide more meaningful relief to those who really need it. Until Oklahoma leaders are ready for a discussion about comprehensive tax reform, strengthening the Sales Tax Relief Credit remains the best and most fiscally responsible option to provide relief from the sales tax on groceries.

OKPOLICY.ORG

OKPOLICY.ORG